As a business owner and a worker, it is critical that you know how to distinguish an independent contractor from an employee. Your tax responsibilities and eligibility for benefits relies on the proper classification. The IRS has established categories that can help you make the distinction.

Distinguish the Difference

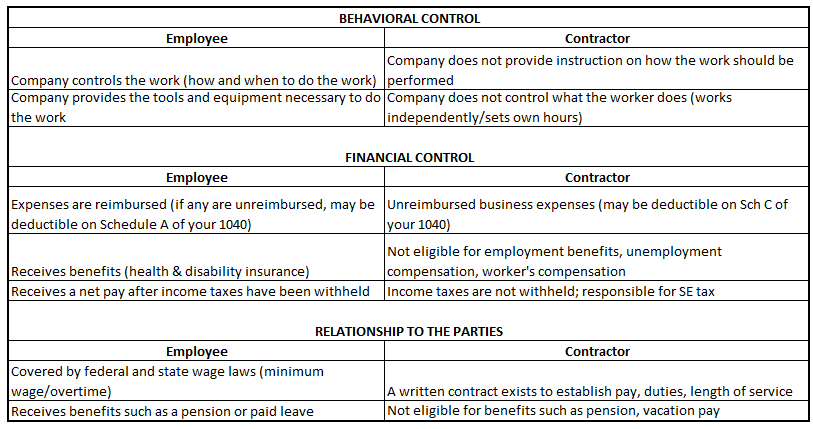

To properly classify a worker, consider the following categories:

Assess and Determine

The IRS has not established a set number of factors that would indicate if the worker is an employee or subcontractor. The IRS suggests that you look at the entire relationship and the level of control. If a determination is made, document the facts and circumstances to support your decision. If still unclear, the IRS can provide guidance in your determination if you file Form SS-8 (Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding). Allow up to six months for the IRS to review the facts and circumstances of your case.

Misclassification

Misclassifying your employees or contractors can have a major impact on the worker and the business. Employees that are misclassified as contractors miss out on employer sponsored benefits and are not protected by federal or state wage or antidiscrimination laws. In addition, if the employee is terminated, they are not eligible for unemployment benefits or worker’s compensation if classified as a contractor.

If the IRS determines a misclassification, a business may be held liable for years of exposure due to unpaid employment taxes. If a business can provide a reasonable basis for their determination, the IRS may relieve the business from paying employment taxes for that worker.

Conclusion

The classification of a worker is an important decision for a business to make. Businesses need to understand the difference and the legal obligations as a result of that decision. Make sure to fully document your basis in case you ever need to find relief in the future.

If you have any questions on the classification of independent contractors, contact the Accounting Solutions Group.

About the Author