Administrators of benefit plans, particularly as a plan is growing in participants, often ask themselves each year if their benefit plan must be audited as a result of the Employee Retirement Income Security Act (ERISA).

Under ERISA, “large plans” are required to have an audit of the financial statements. As a general rule, large plans are those with 100 or more participants at the beginning of the plan year, and small plans are those with fewer than 100 participants. Yet with all rules there are exceptions which is where the 80/120 Rule comes into play.

It is also important to clarify what constitutes a “participant”.

For plan years beginning before January 1, 2023, a participant includes (a) those who are actively participating in the plan, (b) retired, deceased or separated employees who still have assets in the plan, and (c) all eligible employees who have yet to enroll or have elected not to enter the plan.

For plan years beginning on January 1, 2023, and after, a participant is someone with an account balance in the Plan, even if not currently deferring.

It is also important to clarify what constitutes a “participant”. A participant includes (a) those who are actively participating in the plan, (b) retired, deceased or separated employees who still have assets in the plan, and (c) all eligible employees who have yet to enroll or have elected not to enter the plan.

80/120 Rule

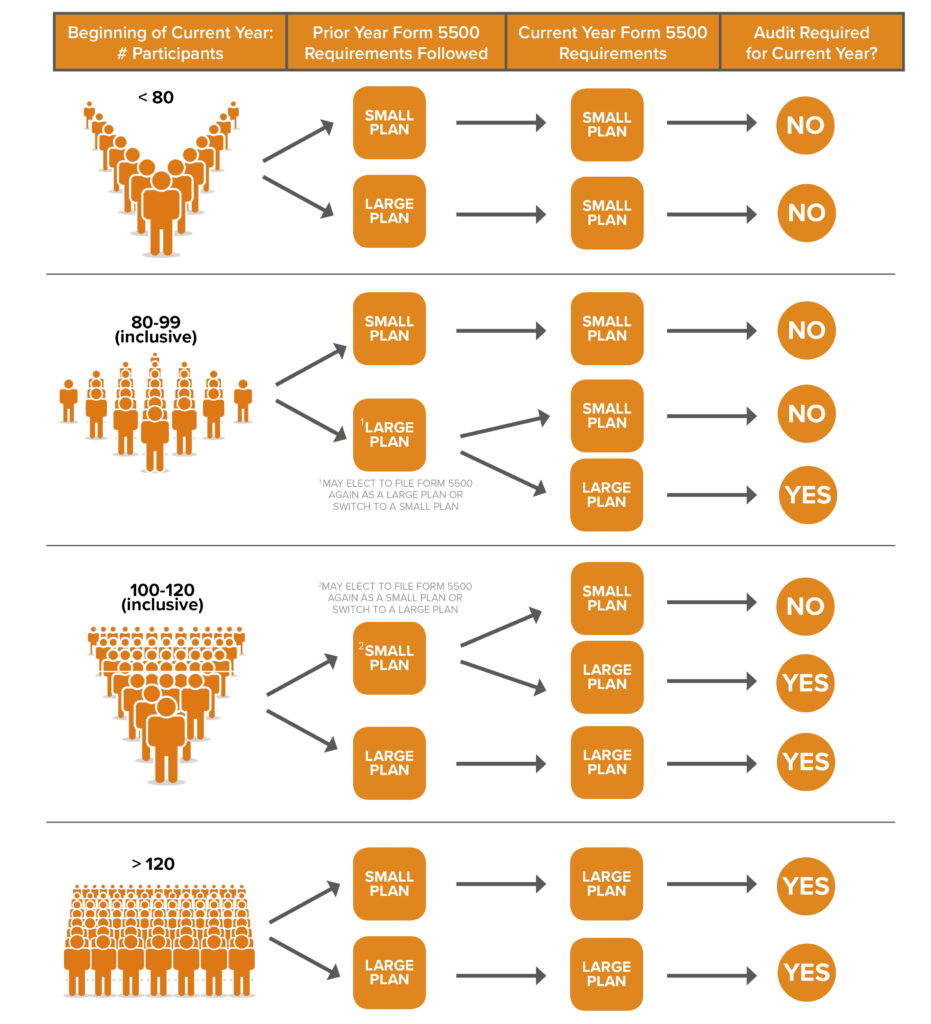

The 80/120 rule applies for those plans that fluctuate between 80 and 120 participants each plan year. In its simplest form, those plans with participants between 80 and 120 at the beginning of a plan year may consider using the same category—a small plan or a large plan—that was used in the previous plan year. Of course, it is never that simple. Here we look to illustrate how the 80/120 rule works.

Contact Us

If your benefit plan participants hover between 80 to 120 participants year after year, whether a benefit plan audit is required will typically continue to cause confusion. At Selden Fox, we can help. If you are reviewing the above information and have questions or wish to discuss further, please contact us. Call us at 630.954.1400 or click here to contact us. We look forward to speaking with you soon.