The purpose of this article is to provide an overview regarding the impact of the FASB Accounting Standards Codification – Topic 606, Revenue from Contracts with Customers (ASC 606) on For Profit / Manufacturing entities.

The purpose of this article is to provide an overview regarding the impact of the FASB Accounting Standards Codification – Topic 606, Revenue from Contracts with Customers (ASC 606) on For Profit / Manufacturing entities.

This article, and the related articles, provides a brief overview of ASC 606 and omits requirements specific to public entities and many optional disclosures for non-public entities. ASC 606 and related guidance should be referred to for additional information and detail.

The new revenue recognition framework is effective for non-public entities presenting U.S. GAAP financial statements for periods beginning after December 15, 2018, and interim periods within annual periods beginning after December 15, 2019. Early application is permitted for non-public entities one year prior to the aforementioned effective periods. For entities presenting IFRS financial statements, the framework is effective for annual periods beginning on or after January 1, 2018.

ASC 606 instructs the entity to recognize revenue for the transfer of goods or services in an amount that reflects the consideration which the entity expects it is entitled to receive from customers in exchange for those goods or services. Customers are defined as a party that has contracted with an entity to obtain goods or services in the ordinary course of business in exchange for consideration. The following steps should be applied:

- Identify the contract(s) with a customer.

- Identify the performance obligation(s) in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligation(s) in the contract.

- Recognize revenue when (or as) the entity satisfies a performance obligation.

Transfer of a promised good or service to a customer in satisfaction of performance obligations results in revenue recognition. This occurs when the customer obtains control of the good or service.

A contract with a customer may create legal rights and obligations whether or not the contract is in writing. The rights and obligations under the contract may, in turn, give rise to contract assets and contract liabilities.

Contract Assets: Commonly referred to as unbilled receivables and progress payments to be billed. A contract asset is an entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer. These assets arise when goods or services have been transferred to a customer but customer payment is contingent on a future event.

Contract Liabilities: Commonly referred to as deferred revenue and unearned revenue. A contract liability is an entity’s obligation to transfer goods or services to a customer for which the entity has received consideration from the customer.

The proceeding content provides a practical application of the new guidance using hypothetical scenarios to explain certain contractual arrangements common to manufacturing entities.

Illustrative Example 1 – Accounting for Variable Consideration

XYZ Company designs and manufactures equipment, provides contract maintenance services, and sells supplies and other components to its customers.

Scenario 1

During 2019, XYZ enters into 10 contracts with customers for the sale of one component to each customer for $50 of consideration each. Components may be returned within 45 days for a full refund. The cost of each component is $40. XYZ utilizes the expected value method as it accurately portrays the amount of consideration to which XYZ expects to be entitled. XYZ estimates that one component will be returned. When the component is transferred, XYZ will not recognize revenue for one component expected to be returned. The journal entries made once the components are transferred are as follows:

| Receivable (10 components x $50) | $500 | |

| ‘ Refund Liability (1 component x $50) | $50 | |

| ‘ Revenue (9 components x $50) | $450 |

| Cost of sales (9 components x $40) | $360 | |

| Asset (1 component x $40) | $40 | |

| ‘ Inventory (10 components x $40) | $400 |

Scenario 2

Conversely, assume the same facts as in the previous example except that XYZ has no relevant historical evidence of component returns or other market evidence upon which to base estimated returns. Revenue can’t be recognized until the right to return lapses if XYZ can’t estimate returns. The journal entries would be as follows:

When the component is transferred to the customer(s):

| Asset for the right to recover component to be returned (10 components x $40) | $400 | |

| ‘ Inventory (10 component x $40) | $400 |

When the right of return lapses (45 days – the components are not returned)

| Receivable (10 components x $50) | $500 | |

| ‘ Revenue (10 components x $50) | $500 | |

| Cost of sales (10 components x $40) | $400 | |

| ‘ Asset for the right to recover component to be returned (10 components x $40) | $400 |

Scenario 3

XYZ enters into a contract with a customer to sell a component for $10 per unit on January 1, 2019. If the customer purchases more than 50 units during 2019, the price per unit for all units purchased will be $9. Based on historical data, XYZ determines it is likely that the customer will meet the 50 unit threshold and receive the discounted price per unit of $9. If the customer purchases 40 units at $10 per unit ($400 total), XYZ would record the following to recognize revenue at the time of sale (ignoring costs of sales):

| Receivable (40 units x $10) | $400 | |

| ‘ Volume rebate/contract liability (40 units x $1) | $40 | |

| ‘ Revenue (40 units x $9) | $360 |

Illustrative Example 2 – Accounting for Contract with Multiple Performance Obligations That Spans Multiple Years

On January 1, 2019, XYZ enters into a contract with a customer to transfer equipment and perform maintenance services for three years to a customer. The contract requires the equipment to be delivered first for consideration of $6,000. Consideration for maintenance services amounts to $2,000 per year. Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. The resulting allocation of the transaction price to each performance obligation on a stand-alone selling price basis results in 20 percent of the revenue ($2,400) allocated to the equipment, and 80 percent of the revenue ($9,600) allocated to the maintenance. On January 1, 2019, the customer receives the equipment and pays the entity $4,000.

Depending on XYZ’s existing accounting policies, either of the following alternatives are acceptable:

Alternative A – The following journal entries are made to account for the contract.

On January 1, 2019, equipment is transferred to the customer and payment of $4,000 is received:

| Equipment | ||

| Cash (20% x $4,000) | $800 | |

| Receivable | $1,600 | |

| ‘ Revenue | $2,400 |

| Maintenance | ||

| Cash (80% x $4,000) | $3,200 | |

| Contract Asset (years 2 & 3) | $6,400 | |

| ‘ Contract Liability (years 2 & 3) | $9,600 |

| Combined | ||

| Cash | $4,000 | |

| Receivable | $1,600 | |

| Contract Asset (years 2 & 3) | $6,400 | |

| ‘ Contract Liability (years 2 & 3) | $9,600 | |

| ‘ Revenue | $2,400 |

On January 31, 2019 (and each month thereafter), XYZ would recognize revenue for maintenance services as follows:

| Contract Liability (($9,600/6) x 1 mo) | $267 | |

| ‘ Revenue | $267 |

Alternative B – XYZ would allocate cash to the satisfied performance obligations (the equipment and the satisfied portion of the maintenance) while recording the remaining consideration due associated with the satisfied performance obligation as an unbilled receivable. Essentially, not presenting a contract liability for maintenance paid for by the customer before performance.

The following journal entries are made to account for the contract.

On January 1, 2019, equipment is transferred to the customer and payment of $4,000 is received:

| Combined | ||

| Cash | $4,000 | |

| Contract Asset (years 2 & 3) | $8,000 | |

| ‘ Contract Liability (years 2 & 3) | $8,000 | |

| ‘ Payments in excess of billings | $1,600 | |

| ‘ Revenue | $2,400 |

Note: The Contract Asset and Contract Liability are netted to $0 for reporting purposes.

On January 31, 2019 (and each month thereafter), XYZ would record the following journal entry:

| Maintenance | ||

| Payments in excess of billings | $267 | |

| Contract Liability (($9,600/36) x 1 mo) | $267 | |

| ‘ Contract Asset (($9,600/36) x 1 mo) | $267 | |

| ‘ Revenue | $267 |

Note –Contract assets and liabilities are reported net in the financial statements for each contract or each group of contracts and would result in a net contract liability for Alternative A of $3,200 ($9,600 less $6,400) along with the receivable of $1,600 and for Alternative B of $0 ($8,000 less $8,000 along with a payment in excess of billings of $1,600. Both cases result in a net overall liability position of $1,600 representing cash received in excess of obligations delivered.

Illustrative Example 3 – Accounting for Incremental Costs to Obtain a Contract

Scenario 1

XYZ sells two-year service contracts to its customers for the maintenance of equipment. The services are performed evenly throughout the life of the contract. Contracts do not provide for any renewal provisions. Sales agents receive a one-time commission of $500 per contract sold. A sales agent successfully negotiates contracts with three customers during the month and, in doing so, incurs $1,000 of costs for travel, food, and lodging. XYZ also pays the sales agent a salary of $4,000 per month.

The sales agent’s salary and the $1,000 costs for travel, food, and lodging are expenses that XYZ would incur whether or not the contract was obtained; therefore, are expensed as incurred. XYZ would record an asset for the $1,500 commission ($500 x 3 contracts) and amortize the asset over the life of the contracts. XYZ may choose to record three separate assets of $500 for each contract or utilize a portfolio approach and record one asset of $1,500. Based on these circumstances, the contracts are similar and a portfolio approach was deemed appropriate.

Scenario 2

Assume the same facts in the previous example except that after one year into the two-year term of the contracts, the contracts are re-negotiated and XYZ will only receive remaining consideration of $2,000. On the date of renegotiation, the asset’s carrying value is $750 and the costs to provide the services for the remainder of the contract are $1,500. The firm would recognize an impairment loss on the asset in the amount of $250 (expected consideration of $2,000 less costs of providing the services $1,500 = $500. Asset or contract carrying value $750 – $500 = $250 impairment loss).

Refer to the following article for further information regarding contract costs: Costs to Obtain or Fulfill a Contract With a Customer.

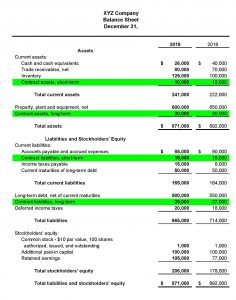

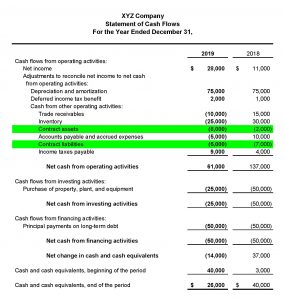

Illustrative Example 4 – Financial Statement Presentation and Note Disclosures

Notes to the Financial Statements

Summary of Significant Accounting Policies

XYZ generates revenue primarily by delivering supplies, manufacturing and installing equipment, and performing maintenance services for customers.

Revenues from the sale of supplies and equipment is recognized when the supplies or equipment are transferred to the customer, the customer obtains control of the component (risk of loss passes to the customer), no significant obligations remain, and estimation of return liabilities is reasonably estimated. Progress billings and up-front payments received as part of a contract to manufacture equipment are deferred until control of the equipment transfers to the customer based on contract terms. Revenue is recognized from performance of maintenance services when the services have been provided or delivered. Furthermore, revenue from performance of maintenance services are recognized only if the collectability is likely and the fees charged are determinable.

Sales of components and services are evaluated in order to recognize revenue based on the net amount earned as revenue. For multi-element contracts, including the sale of equipment and installation, we allocate revenue to each unit of accounting based on each unit’s relative selling price.

Revenue is disaggregated by geographical area, product line, and timing of revenue recognition. XYZ disaggregates revenue from contracts with customers into categories that depict the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors. The following table presents information for the year ended December 31, 2019:

| Segment | Components | Equipment | Maintenance | Total | ||||

| Geographical Region: | ||||||||

| East coast | $20,000 | $30,000 | $25,000 | $75,000 | ||||

| Midwest | 50,000 | 150,000 | 100,000 | 300,000 | ||||

| West coast | 20,000 | 40,000 | 50,000 | 110,000 | ||||

| International | 10,000 | 30,000 | 25,000 | 65,000 | ||||

| 100,000 | 250,000 | 200,000 | 550,000 | |||||

| Major products/services: | ||||||||

| Components | 100,000 | – | – | 100,000 | ||||

| Equipment | – | 250,000 | – | 250,000 | ||||

| Maintenance | – | – | 200,000 | 200,000 | ||||

| 100,000 | 250,000 | 200,000 | 550,000 | |||||

| Timing of Revenue Recognition: | ||||||||

| Goods transferred at a point in time | 100,000 | 250,000 | – | 350,000 | ||||

| Services performed over time | – | – | 200,000 | 200,000 | ||||

| $100,000 | $250,000 | $200,000 | $550,000 | |||||

Contract liabilities represent payments received from customers prior to the satisfaction of the corresponding performance obligations. Contract liabilities are recognized as revenue once the corresponding performance obligations are satisfied based on the contract with the customer. Contract assets represent the Company’s right to consideration based on satisfied performance obligations from contracts with customers.

| 2019 | 2018 | |||||

| Contract asset | $40,000 | $32,000 | ||||

| Contract liability | (40,000) | (45,000) | ||||

| Revenue recognized in the period: | ||||||

| Performance obligations satisfied in a prior period | 10,000 | 9,000 | ||||

| Amounts included within contract liabilities at the beginning of the reporting period | 12,000 | 11,000 | ||||

The changes in the contract balances occurred in the ordinary course of business.

When contracts are entered into with customers for the manufacture and sale of equipment, it is typical that a maintenance component exists for periods in excess of one year. The following table illustrates the revenue anticipated to be recognized on these contracts as of December 31, 2019:

| 2020 | 2021 | |||||

| Revenue expected to be recognized on contracts | $50,000 | $40,000 | ||||

Accounting Changes

During 2019, XYZ adopted the provisions of ASU 2014-09 Revenue from Contracts with Customers (Topic 606). The change in accounting principle was applied retrospectively. The effect on the December 31, 2018, financial statements is summarized in the following table:

| As Previously Reported | Restated | |||||

| Balance Sheet: | ||||||

| Trade receivables, net | $75,000 | $70,000 | ||||

| Contract assets, short-term | – | 12,000 | ||||

| Total current assets | 227,000 | 220,000 | ||||

| Contract assets, long-term | – | 20,000 | ||||

| Total assets | 919,000 | 892,000 | ||||

| Contract liabilities, short-term | – | 18,000 | ||||

| Total current liabilities | 146,000 | 164,000 | ||||

| Contract liabilities, long-term | – | 27,000 | ||||

| Total liabilities | 669,000 | 714,000 | ||||

| Stockholders’ equity: Retained earnings | 149,000 | 77,000 | ||||

| Total stockholders’ equity | $250,000 | $178,000 | ||||

| Statement of Operations: | ||||||

| Net sales | $600,000 | $550,000 | ||||

| Cost of sales | 380,000 | 375,000 | ||||

| Gross profit | 220,000 | 125,000 | ||||

| Selling, general and administrative | 98,000 | 75,000 | ||||

| Total expenses | 130,000 | 107,000 | ||||

| Net income | $83,000 | $11,000 | ||||

Many entities and their accountants will find the implementation of the new revenue standard to be challenging. Even if an entity determines that based on the transaction cycle, amounts of revenue recognized would not be affected by the new standard, certain disclosure requirements will be necessary.

Contact Us

If you have questions on how the new revenue recognition will affect your entity, Selden Fox can help. For additional information please call us at 630.954.1400, or click here to contact us. We look forward to serving you soon.