Beginning January 1, 2024, the beneficial ownership information (BOI) reporting requirements started and will be phased in over a two-year period as mandated by the 2021 Corporate Transparency Act. Under these new rules, covered entities must report specified information about certain owners and officers to the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and must timely update any changes going forward. Failure to comply with these requirements can result in significant penalties.

The information required for filing is initially designed to be used by various governmental organizations to address issues of money laundering and criminal activities including tax evasion, human trafficking, and sanction evasions using shell companies.

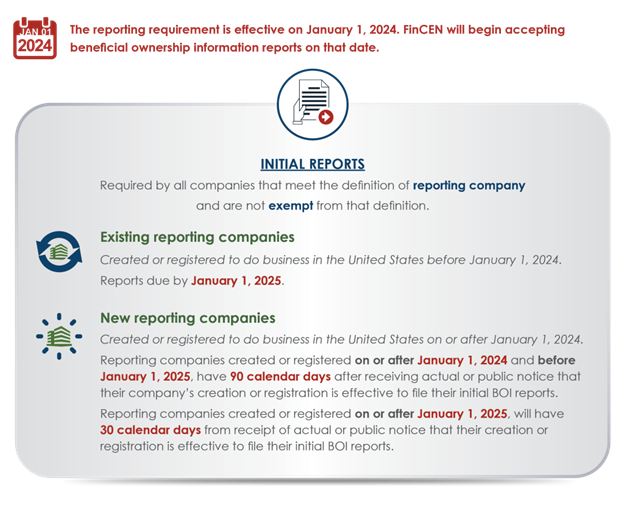

When are BOI Reports Due?

For entities in existence prior to January 1, 2024, the initial report is due on January 1, 2025, however, now is the time to start preparing for the reporting requirements. Subsequent reports are due within 30 days of a change in any beneficial ownership information or loss of an exemption. If an error is identified in a report, a corrected report is due within 30 days. For applicable entities newly created having filed with the Secretary of State as of January 1, 2024, are required to file their BOI reports within 90 days of their Secretary of State filing.

Source: https://www.fincen.gov

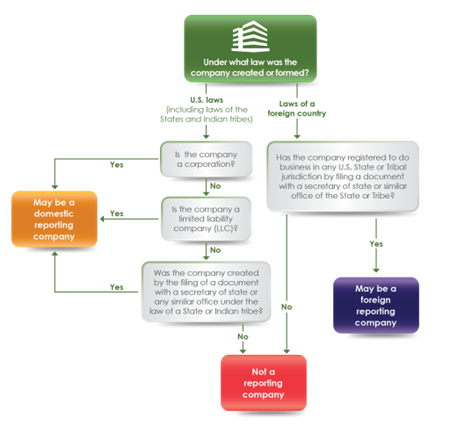

What Companies Must File BOI Report?

FinCEN estimates that there are more than 32 million existing entities that must comply with these new requirements. The mandate generally applies to midsize and small businesses because these are the entities that have historically been used by money launderers. All domestic corporations, LLCs including single member LLCs, S-Corps, or an entity created by filing documents with a Secretary of State’s office. Additionally, any foreign corporation, LLC, or entity formed under the law of another country and registered to do business in any state by the filing of a document with the Secretary of State.

Each entity is required to file their own report (i.e., a parent company cannot file a single report for its group of companies; each company must file their own). There are more than 23 exemptions as it relates to what companies must file. The most practical exemption is for large operating companies, defined as 20 or more full time employees, a US physical office, and more than $5 million in gross receipts from sales inside the United States as reported on the previous year’s company tax return.

Source: https://www.fincen.gov

What Must be Reported?

Companies required to file BOI will need to report basic company information as well as company applicants and beneficial owner(s). This information includes name, date of birth, residential address, ID from specific document, and an image from the specific document. Reporting companies or individuals who may be beneficial owners of multiple entities can get a FinCEN reporting number preassigned to them, so they don’t have to provide this personal information multiple times.

Who are Company Applicants and Beneficial Owners for BOI Purposes?

Entities will need to determine who are their company applicants and beneficial owners for BOI purposes. As defined by BOI requirements:

- Company applicants can be up to two individuals: the individual who directly files incorporating documents and the individual responsible for directing or controlling the filing of the documents by another. A company applicant is not necessarily going to be employed by the company. It could be a law firm that handles the filing in which case the employee(s) at the law firm will need to disclose their information in that company’s filing.

- Beneficial owner(s) are any individual(s) who directly or indirectly either exercise substantial control over the reporting company (even if they have no ownership) or own or control at least 25% of the reporting company’s ownership interests. Determining beneficial owners based on substantial control will be one of the more difficult components to this new reporting process.

The determination of beneficial owners and required awareness of those owners will be critical for entities in terms of staying in compliance with the reporting requirements and will require careful consideration when determining substantial control.

What are the Penalties for Not Compiling with BOI Reporting?

Penalties for failure to comply with this new mandate start at $500 per day with no cap on this daily penalty. This alone makes it critical that you are ready to comply with the reporting requirements well in advance of the due date. Additionally, and most important, these penalties can be assessed against the entity and the individual(s) who cause the failure or is an officer of the entity at the time of the failure. Criminal penalties can be up to $10,000 and or imprisonment of up to two years for any individual who willfully and intentionally reports incomplete or false information. Being unaware of the reporting requirements will not be an adequate defense for failing to comply.

Contact Us

Confirming if you are required to file a BOI report is the first step to this process and should be assessed sooner rather than later. Discussing applicability with your attorney or contacting Selden Fox to discuss is a good first step. Although we will not be filing BOI reports on behalf of clients, we are happy to assist you and your organization with the process or refer you to a law firm that could assist. If you have any questions related to the Beneficial Ownership Information reporting requirements, Selden Fox can help. For additional information call 630.954.1400 or click here to contact us.